Why Easy Open Ends Are Preferred for Packaging

Dec 09, 2025

In the fast-paced world of consumer goods, packaging is more than just a protective layer—it’s a key touchpoint that influences purchasing decisions and user satisfaction. Among the various packaging components, easy open ends (EOEs) have become increasingly preferred by both brands and consumers, and for good reason. Their unique combination of convenience, functionality, and safety addresses many of the pain points associated with traditional packaging closures.

Convenience is undoubtedly the top driver behind the popularity of EOEs. Unlike traditional can openers that require additional tools and effort, EOEs allow consumers to open cans quickly and easily with just their hands. This is particularly valuable in on-the-go scenarios, such as picnics, travel, or busy households, where convenience can significantly enhance the user experience. For brands, this translates to higher consumer satisfaction and repeat purchases, as users are more likely to choose products that are easy to use.

Another key advantage of EOEs is their superior sealing performance. When properly manufactured, EOEs create a hermetic seal that effectively preserves the freshness, flavor, and quality of the contents. This is critical for perishable products like food and beverages, as it extends shelf life and reduces the risk of spoilage. Additionally, EOEs offer excellent protection against external contaminants, such as dust, moisture, and bacteria, ensuring that products remain safe for consumption until they are opened.

EOEs also provide brands with opportunities for branding and differentiation. The surface of EOEs can be customized with logos, brand colors, and promotional messages, helping to increase brand visibility and recognition. This is especially important in crowded retail environments, where products need to stand out from the competition. Furthermore, EOEs are compatible with a wide range of can sizes and shapes, making them a versatile packaging solution for various product categories, from small canned snacks to large industrial containers.

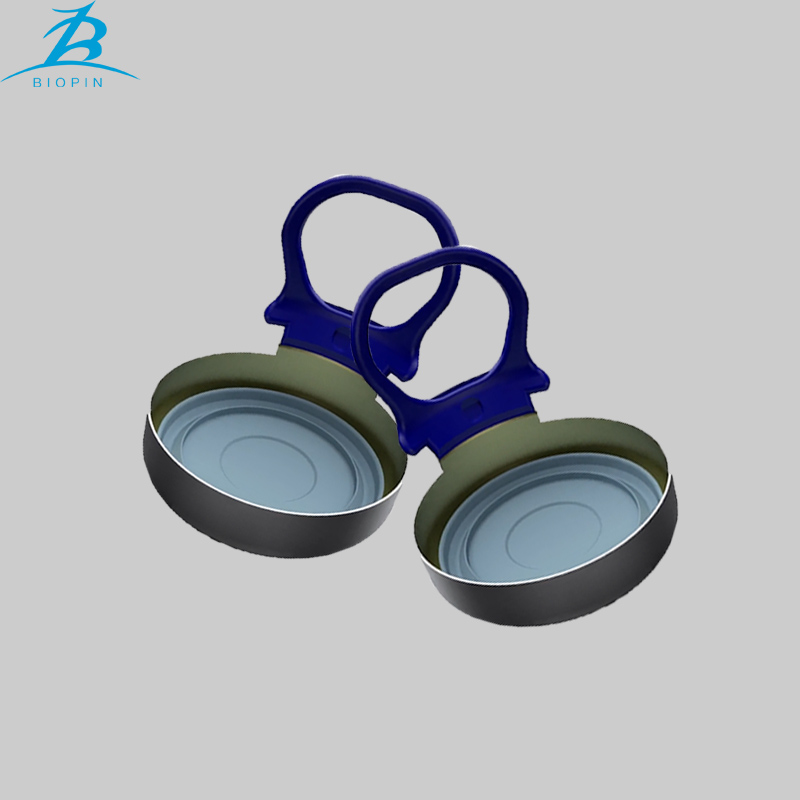

For businesses looking to leverage the benefits of EOEs, BIOPIN is the ideal partner. Our EOEs are engineered to deliver exceptional convenience and sealing performance, ensuring that your products meet consumer expectations for ease of use and quality. We offer extensive customization options, allowing you to tailor the EOE design to your brand identity. What sets us apart, however, is our commitment to customer-centric service. We work closely with you to understand your specific packaging needs, provide expert recommendations, and ensure timely delivery of orders. Whether you’re launching a new product or upgrading your existing packaging, our team is dedicated to supporting your success every step of the way.